What is CIBIL Score?

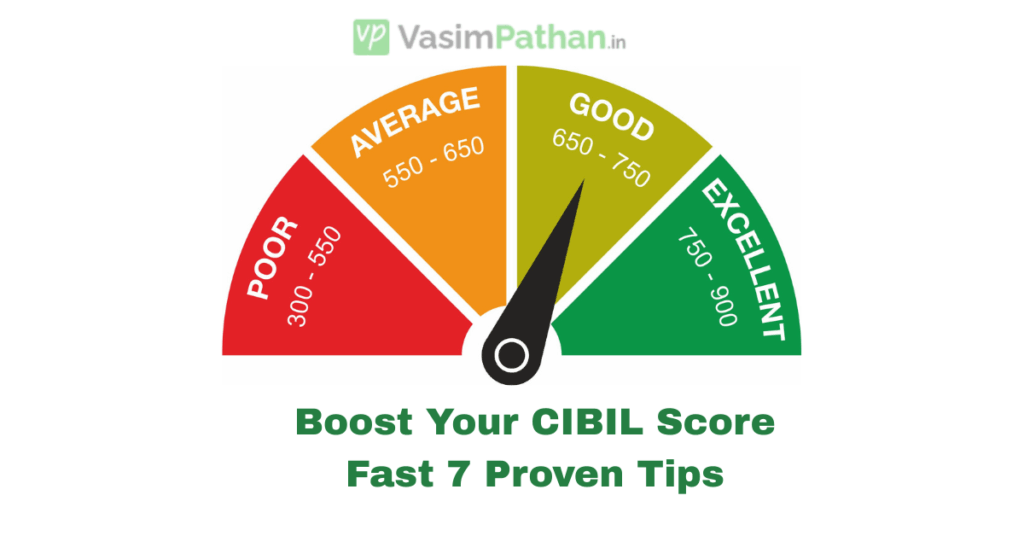

Your CIBIL score is a 3 digit number between 300 and 900 which shows how reliable you are while paying a loan or credit card.

✅ The score above 750 is considered good and helps you easily get a loan or credit card.

📉 Why is my CIBIL score low?

Here are some common reasons:

- Credit card or EMI payment delay.

- High use of credit cards (more than 50% of your limit)

- Too many loan applications

- Loan default or missed payments

- No credit history (new user)

How to Improve Your CIBIL Score (Step-by-Step)

1. Always repay the EMI and credit card bills on time.

Late payment = Negative impact. Set reminders or auto-pay to stay safe.

2. Keep using a credit card less than 30-40%.

If your limit is ₹ 1,00,000, do not spend more than ₹ 30,000 regularly.

3. Check Your CIBIL Report for Errors

Go to CIBIL official site and request your free credit report.

If you find wrong info, raise a dispute to correct it.

4. Do not Apply for Too Many Loans Together

Each loan/credit card inquiry reduces your score slightly.

Only apply when needed.

5. Keep a healthy credit mixture.

Keep both safe (such as home loans) and unsafe (such as credit cards).

Very more unsafe loan = risky profile.

6. Don’t Close Old Credit Cards

Old accounts increase your credit history length = better score.

7. Use a low -range credit card and pay full

This helps to create a good repayment history, even if you are the new borrower.

How long does CIBIL take to Improve the score?

- Small problems: 3-6 months

- Large problems (default): 6-12 months

The main thing is to be regular and disciplined.

Benefits of a Good CIBIL Score (Pros)

- Higher chances of loan approval

If your score is good, lenders are more likely to approve your loan or credit card application. - Lower interest rates

With a strong CIBIL score, you can be eligible for loans at low interest rates, saving you in a long time. - Higher credit limits

Banks can provide you a high credit limit based on your repayment history and score. - Faster approval process

Due to your credit qualification, your loan or credit card application is taken fast action. - Premium credit cards and better eligibility for financial products

You can be eligible for reward cards, balance transfer cards and special loan schemes.

❌ Drawbacks of a Low CIBIL Score (Cons)

- Debt rejection or delay

Lenders can reject your application or take more time in acceptance due to low credit trust. - High interest rates on loans

If approval is received, loans are often provided at higher rates to reduce the risk of the lender. - Low credit card limit or acceptance

You can find only basic cards or can be completely rejected. - Requirement of more documents or guaranteers

When your score is bad, lenders may demand more evidence, collateral or guarantor. - Affects future financial planning

Limited financial support options can be difficult to buy home, car or start a business.

BONUS: Free Tools to Check Credit Score in India

These platforms offer free credit reports and tips.

Final Words

Improving your CIBIL score is not a rocket science – just keep paying regularly, keep the expenses low and do not take unnecessary loans. Follow these steps and you will see positive changes in a few months.

To know this CIBIL information in Marathi please click on below button

LEAVE A COMMENT

Our Services

Discover our range of professional services designed to meet your needs. We provide expert solutions with precision and excellence to help you achieve your goals.

Comments (0)

No comments yet. Be the first to comment!